It is not easy, not even for a person competent in finance and economics, to represent a clear picture of the corporate framework within which Ferrari gravitates and, even more so, to evaluate the possibilities of future development of the Maranello factory. The advent of the newborn Stellantis (born from the merger between FCA and PSA), although not directly linked to Ferrari, now makes it necessary to define a summary of the current situation. In fact, it is not possible to simply cheer for Ferrari without at least being aware of the general guidelines on the ownership structure and the economic and financial situation of our beloved Red.

Ferrari has always not used advertising and communicates exclusively through competitions. Enzo Ferrari did not want sponsors on the cars. “Sponsors pay the drivers,” he said. For some years the Maranello factory has also been a protagonist on the financial scene, being listed on the stock exchange. With this article, we want to outline a general corporate framework, starting with the establishment, at this beginning of the new year, of Stellantis.

Carlos Tavares and John Elkann.

Stellantis N.V. is a Dutch-based multinational automotive manufacturing corporation resulting from the merger of French automaker Groupe PSA and Italian-American automaker Fiat Chrysler Automobiles, following completion of a 50-50 merger agreement. Registered in the Netherlands, the group includes 14 brands: Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS, Fiat, Jeep, Lancia, Maserati, Opel, Peugeot, Ram and Vauxhall. The name Stellantis is exclusively in use as a corporate brand, while its brands' names and logos remain unchanged.

Stellantis, with industrial operations in 30 countries and a commercial presence in more than 130 markets, is a leading global mobility player guided by the mission to provide freedom of movement for all through distinctive, appealing, affordable and sustainable mobility solutions. The Company’s strength lies in the breadth of its iconic brand portfolio, the diversity and passion of its 400,000 people and its deep roots in the communities in which it operates.

In this new era of mobility, its portfolio of brands is uniquely positioned to offer distinctive and sustainable solutions to meet the evolving needs of customers, as they embrace electrification, connectivity, autonomous driving and shared ownership. These brands have made automotive history for more than a century.

The company will be listed in the stock exchanges of Milan, New York and Paris.

Stellantis was born from the merger of FCA and PSA.

In early 2019, FCA sought a merger with French group Renault and reached a provisional agreement with the company. However, the French government did not support this agreement and the merger was withdrawn.

Subsequently, FCA approached PSA. The deal, officially signed in December 2019, is expected to create the world's fourth-largest carmaker by volume and results in an annual cost savings of about €3.7 billion, or $4.22 billion. The process of identifying the new name for the merged company started following the announcement of the $50 billion deal in October 2019.

On 21 December 2020, the European Commission announced its approval of the merger, while imposing minimal remedies in order to ensure competition in the sector.

The merger was confirmed on 4 January 2021, after an overwhelming vote of shareholders from both companies and the deal has been completed on 16 January 2021. Following the deal closure, the combined company will be trading its common shares on the Italian Bourse (Mercato Telematico Azionario) in Milan and Euronext in Paris on 18 January 2021, while the listing on the New York Stock Exchange will occur on 19 January 2021, under the ticker symbol "STLA".

As of 2021 the brand portfolio of Stellantis is:

|

Brand |

Founded |

Current director |

|

|

149 |

Luca Napolitano |

|

|

1910 |

Timothy Kuniskis |

|

|

1925 |

Timothy Kuniskis |

|

|

|

|

|

|

1919 |

Vincent Cobée |

|

|

1914 |

Timothy Kuniskis |

|

|

2014 (spun-off from Citroën brand) |

Béatrice Foucher |

|

|

1899 |

Olivier François |

|

|

1941 |

Christian Meunier |

|

|

1906 |

Antonella Bruno |

|

|

1914 |

Davide Grasso |

|

|

1862 |

Michael Lohscheller |

|

|

1882 |

Jean-Philippe Imparato |

|

|

2009 (spun-off from Dodge brand) |

Michael Koval |

|

|

1903 |

Stephen Norman |

Ownership

Following the 50% FCA and 50% PSA merger, the owners are:

14.4% (Exor; Agnelli family)

7.2% (Peugeot family)

6.2% (French state)

5.6% (Dongfeng Motor Group)

2.4% (Tiger Global)

1.6% (UBS Securities)

0.96% (Vanguard Group)

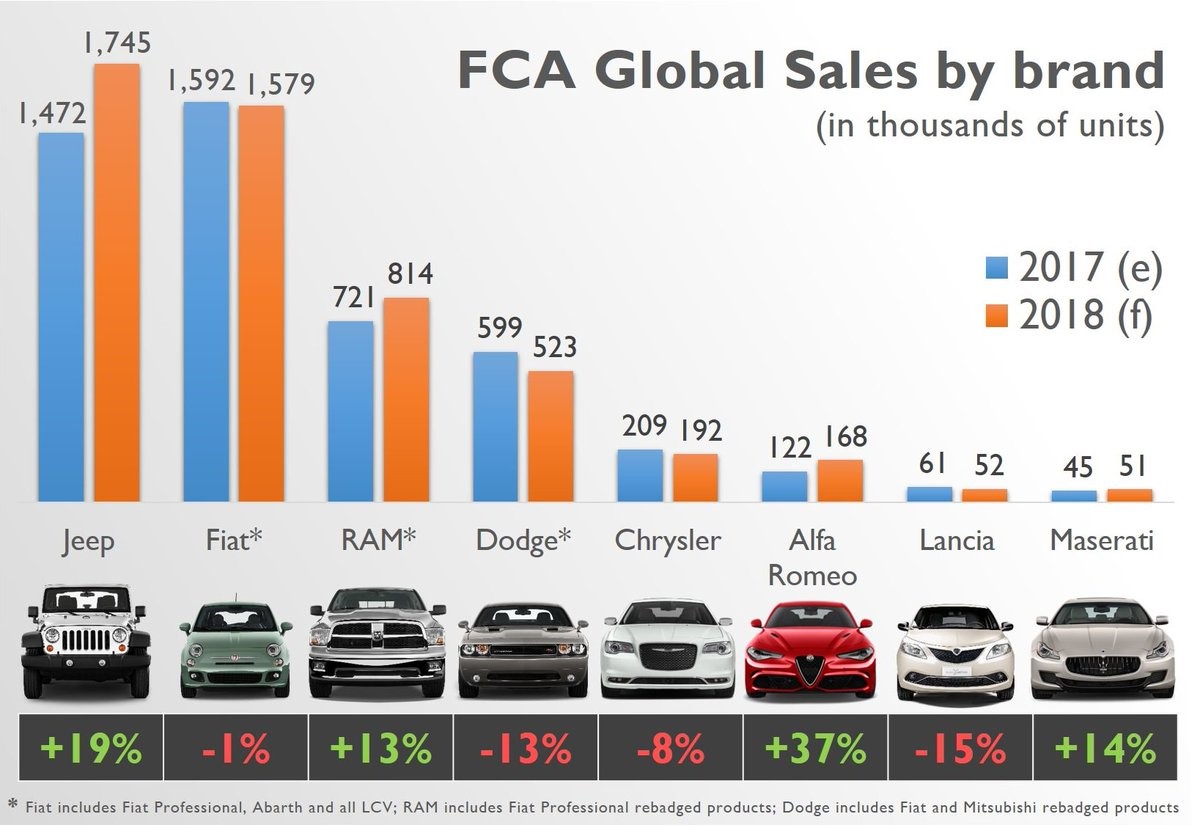

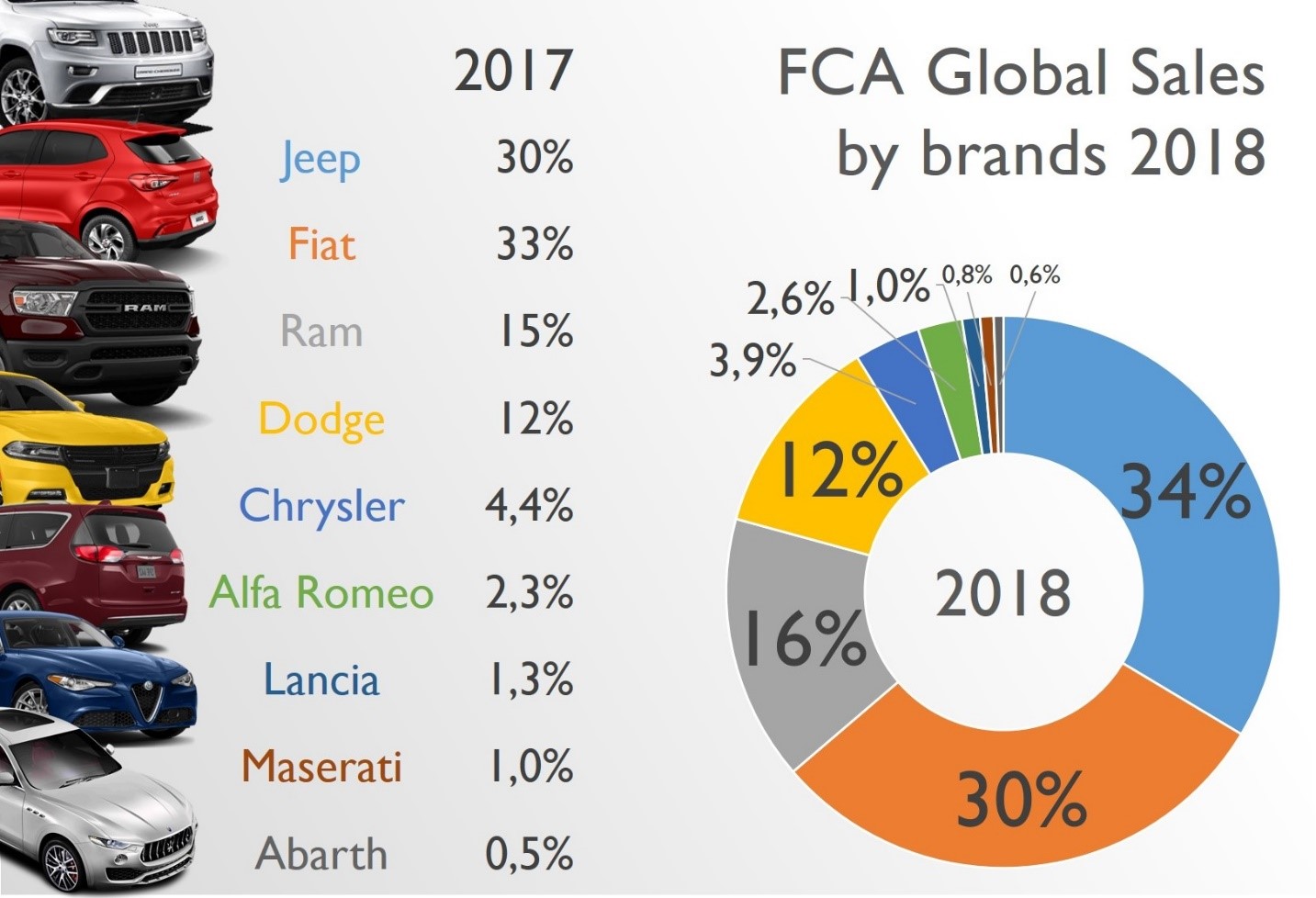

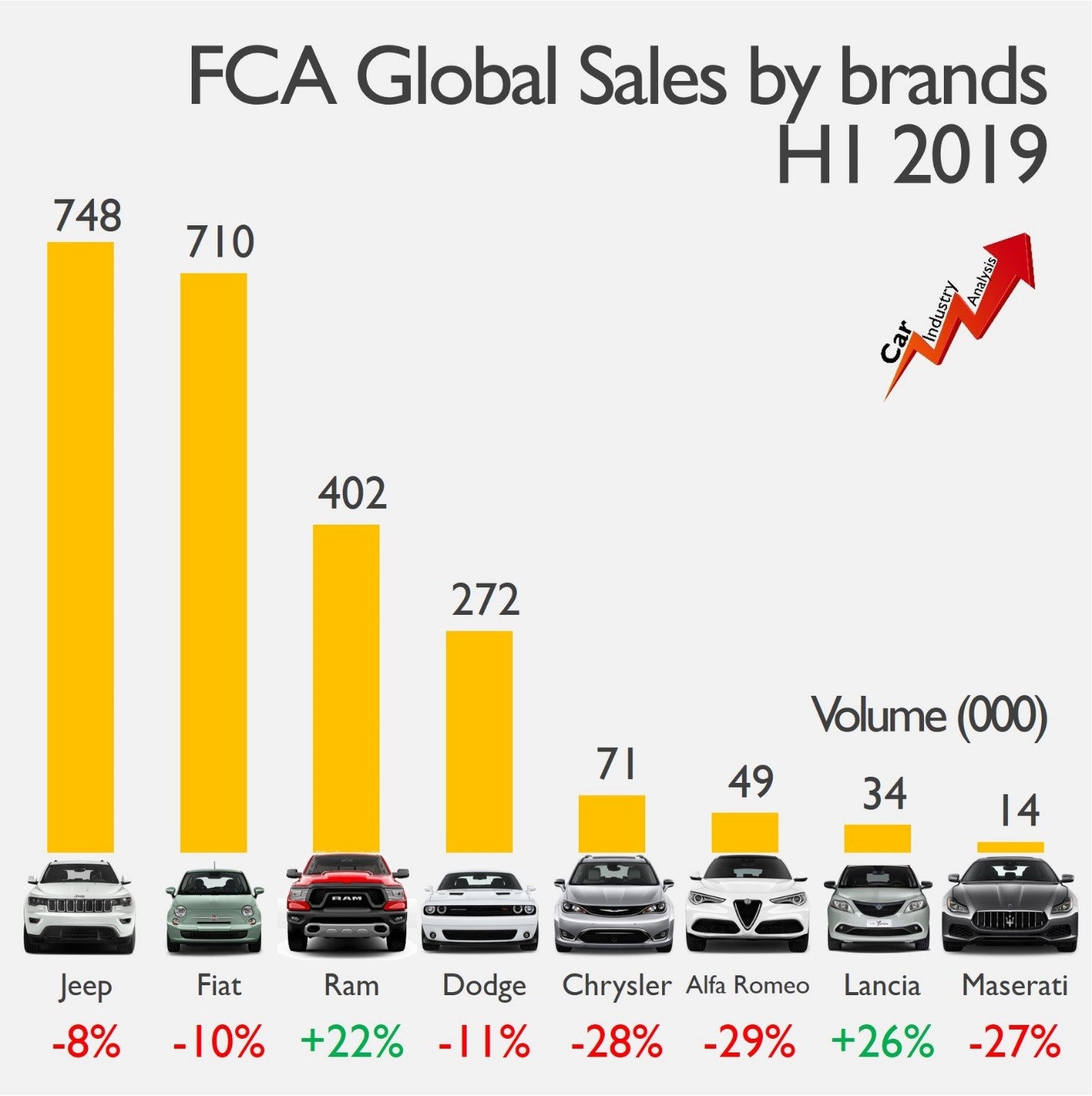

Fiat Chrysler Automobiles (FCA) is a global automaker that designs, engineers, manufactures and sells vehicles in a portfolio of brands, including Abarth, Alfa Romeo, Chrysler, Dodge, Fiat, Fiat Professional, Jeep®, Lancia, Ram and Maserati.

It also sells parts and services under the Mopar name and operates in the components and production systems sectors under the Comau and Teksid brands.

FCA employs nearly 200,000 people around the globe.

Groupe PSA.

Groupe PSA has five car brands, Peugeot, Citroën, DS, Opel and Vauxhall and provides a wide array of mobility and smart services under the Free2Move brand. An early innovator in the field of autonomous and connected cars, Groupe PSA is also involved in financing activities through Banque PSA Finance and in automotive equipment via Faurecia.

In celebration of the first day of Stellantis, John Elkann, Chairman Stellantis and Carlos Tavares, Chief Executive Officer Stellantis, will ring the traditional opening bell of the three stock exchanges where Stellantis shares will be listed.

FCA and Groupe PSA expect to complete the combination on January 16, 2021. After the completion of the transaction, Groupe PSA shareholders will receive 1.742 shares of Stellantis for each PSA share, while FCA shareholders will receive 1 share of Stellantis for each FCA share.

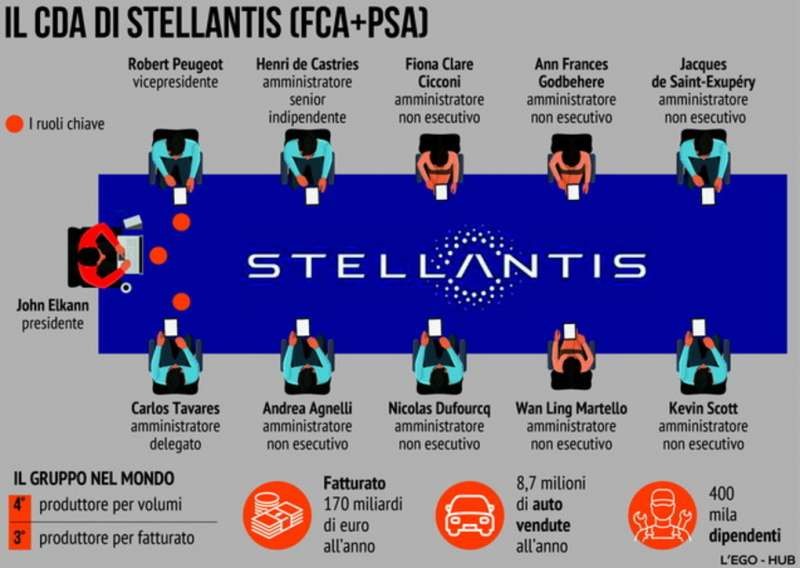

The fourth largest car manufacturer in the world is born, with 8.7 million vehicles sold in 2019, revenues of almost 167 billion euros and profits of around 7 billion. Basically, we are talking about a reality second only to groups of the caliber of Volkswagen and Toyota and to the Franco-Japanese alliance Renault-Nissan-Mitsubishi. With registered office in Amsterdam and general management in Paris, Stellantis will in effect be a multinational with operational offices around the world and a varied shareholder base. Stellantis will be led, as mentioned, by Elkann and Tavares, who will have at their side on the board of directors the vice president Robert Peugeot, Henri de Castries, Andrea Agnelli, Fiona Clare Cicconi, Nicolas Dufourcq, Ann Frances Godbehere, Wan Ling Martello, Jacques de Saint-Exupéry and Kevin Scott. This board of directors and even more so the new management team led by the Portuguese executive will have the task of transforming the intentions reaffirmed by Elkann into reality: "we want to have a leading role in the next decade, which will redefine mobility, just like our founding fathers with great energy in the pioneering years. We intend to play a decisive role in building this new future and it was this ambition that united us. Stellantis, Elkann added, will be one of the largest OEMs in the world. What matters most is that it will be a company with the size, resources, multiplicity of components and know-how necessary to successfully grasp the opportunity for a new era".

The themes of the future. Opportunities, of course, but also challenges. Tavares will have to deal with them in the first place, as he will certainly have a difficult task ahead of him. The new business plan will have to lead to the generation of the 5 billion euros of synergies estimated by the management. Mike Manley, the now former CEO of Fiat Chrysler close to becoming the head of the Americas in the new group, has already explained that the 40% of them will be generated by the sharing of platforms and propulsion systems, by the optimization of "investments in research and development "and the improvement of production processes, 35% from savings on purchases and 7% from cuts in administrative and general expenses.

For the future, it will obviously be necessary to understand how these indications can translate themselves into concrete facts: the sharing of platforms, the positioning in terms of markets and segments of the numerous brands in the portfolio and, in some cases such as Alfa Romeo or Lancia, their relaunch, the fate of the production plants, the management of individual markets and some projects that cannot but be influenced by the birth of Stellantis in both a negative and positive sense.

Lancia entered four D24 cars for the 1954.

In recent days, for instance, uncertainties about the expected return of the Peugeot brand to the United States have increased: the manager Jean-Philippe Imparato revealed the possibility of a review of the entire operation in light of the consolidated presence of FCA's current brands. On the contrary, the union of the forces of two groups, considered "in good health" by their respective managers, could accelerate the path towards electrification or the solution of some problems, such as poor penetration in important markets, starting with the Chinese one, or the expected expansion of a still limited range for various brands, with the relative favorable impacts on the use of production capacity.

In corporate finance, mergers and acquisitions (M&A) are transactions in which the ownership of companies, other business organizations, or their operating units are transferred or consolidated with other entities. As an aspect of strategic management, M&A can allow enterprises to grow or downsize and change the nature of their business or competitive position.

From a legal point of view, a merger is a legal consolidation of two entities into one, whereas an acquisition occurs when one entity takes ownership of another entity's stock, equity interests or assets. From a commercial and economic point of view, both types of transactions generally result in the consolidation of assets and liabilities under one entity and the distinction between a "merger" and an "acquisition" is less clear. A transaction legally structured as an acquisition may have the effect of placing one party's business under the indirect ownership of the other party's shareholders, while a transaction legally structured as a merger may give each party's shareholders partial ownership and control of the combined enterprise. A deal may be euphemistically called a merger of equals if both CEOs agree that joining together is in the best interest of both of their companies, while when the deal is unfriendly (that is, when the management of the target company opposes the deal) it may be regarded as an "acquisition".

In the Stellantis organization chart, out of 43 managers only 18 are in the hands of former Fiat Chrysler and 5 of these manage the brands in the US (where PSA does not operate) and the remaining 25, including Tavares, come from the Paris-based company.

From FCA to Stellantis, this is how the long Italian history of Fiat ends after just over 120 years. Exor is the first shareholder but the prospectus for admission to the market of Stellantis, having to specify who bought who, specifies: "FCA and PSA's management determined that PSA is the acquirer for accounting purposes and, as such, the merger is accounted for as a reverse acquisition". Clearly, Exor sold Fca to Peugeot, becoming a major shareholder of this.

The board of directors' regulations stipulate that President John Elkann will be consulted on strategic issues related to the future of the company.

The CEO of Stellantis, Carlos Tavares, has embarked on a first tour of the Italian factories that are now part of the new group, an operation to reassure the unions that are wondering about the future of the occupation. Last Wednesday the manager visited Mirafiori, the hub of models electrification. On Thursday he went to Melfi, where the Jeep Compass and Renegade are assembled, also in the plug-in hybrid version and the Fiat 500X.

On Friday he stopped in Cassino, perhaps the least exploited site in the FCA production system, to which the new head of Alfa Romeo, Jean-Philippe Imparato, will have to give a strong push. In Poland, at the Tychy site, the production of three electrified B segment models, a Jeep, a Fiat and an Alfa Romeo, engineered on a PSA platform, will start from the second half of 2022.

Tavares has assured Cassino that he does not foresee job cuts and closures of Italian factories, which have been interested in lay-off for too many months. The union leaders were received with great courtesy, they said they had never seen, in recent times, any CEO of the group sitting with them to answer questions.

Specifying that Mike Manley, the last CEO of FCA now passed to direct the operations of the North and South America regions, has never visited this plant, underlining that the style of Tavares seems very close to that of Sergio Marchionne who has always shown great attention to the workers, so much so that each meeting ended with an ovation.

Jean Philippe Imparato, CEO Peugeot.

Since the agreement signed in December 2019, it was clear that Tavares would be the undisputed number one of Stellantis, confirming that the new company - as reported by the documents of the Sec (Securities and exchange commission) - was born from the acquisition of FCA by part of the French of Psa.

The board of Stellantis.

John Elkann, in an interview with the newspaper Le Figaro, confirmed that "as in the past, I will be a president who is lucky enough to be able to work alongside a very competent manager". For Tavares, the important functions are related to product development and marketing.

A woman, Silvia Vernetti, will lead the Global corporate office, practically occupying the location in Amsterdam, Holland, where Stellantis has its headquarters. In the foreground, Maxime Picat, head of Europe (which also includes Russia), will have to manage the balance and the annexation of the various brands that have always been present in this region, considered fundamental for now.

Olivier Bourges, one of Tavares' most trusted advisors, has the task of planning the strategies, which are essential to complete the internationalization of the group. Linda Jackson was entrusted with the Peugeot brand, a symbol of the industry beyond the Alps: in these two years she seemed to have disappeared from the scene, while she joined Tavares to design the integration that led to the creation of Stellantis.

A decisive position was given to Yves Bonnefont, chief software officer, the man capable of designing high-level computer systems, in which coding, environments and automation mechanisms standards coexist.

Agnelli in the Stellantis Board of Directors and his relations with Elkann. By Larry Newport. 6 October 2020.

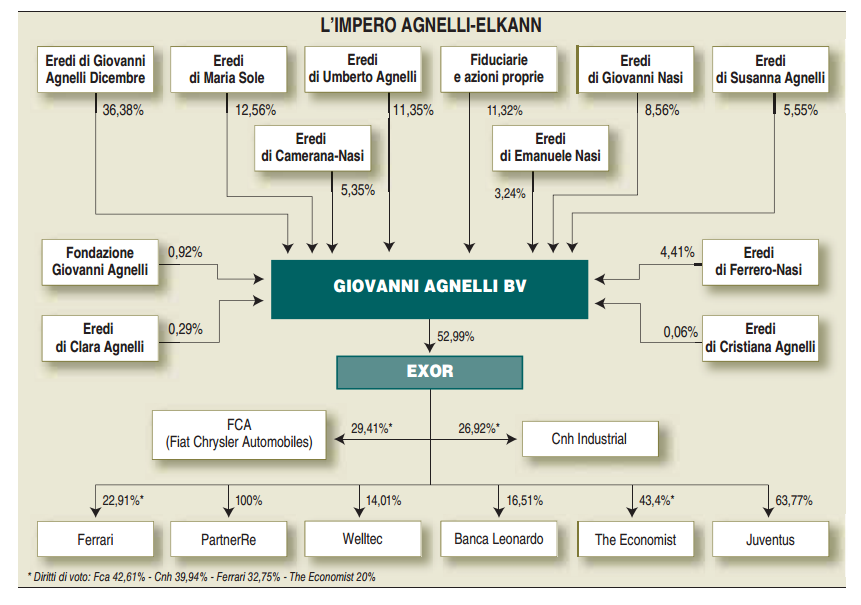

According to what transpires from Turin, the appointment of Andrea Agnelli to the board of directors of Stellantis signals the beginning of an era within the Agnelli family in which three members of the dynasty (all between 40 and 50 years old), John Elkann, Andrea Agnelli and the other cousin Alessandro Nasi, are emerging as the standard bearers of the family business for the next few years.

If relations between Elkann and Nasi have always been excellent, it is more difficult to say whether the appointment of Agnelli as the only other representative of the family on the board of directors of the most important subsidiary of the family holding Exor is the result of a newfound harmony between Agnelli and Elkann (about whose scarce personal relationships there has been much rumor in the recent past) or if Elkann, who remains indisputably the leader of the family, with this move has decided to please the other weighty branches of the dynasty when FCA is heading towards an historical merger.

The fact is, however, that the Agnelli-Elkann dynasty has now chosen the horses to focus on for its future:

• John Elkann, president of FCA, Ferrari and Exor, who remains the absolute head of the family by virtue of the fact that, through his company December, he is the first shareholder of Giovanni Agnelli Bv, the Dutch safe that controls Exor which, in cascade, controls Fca, Gedi, Ferrari, The Economist, PartnerRe and Juventus (see graph).

• Andrea Agnelli, president of Juventus and of the ECA and member of the board of Exor, as well as the only other representative of the family (with Elkann) on the board of directors of Stellantis.

• Alessandro Nasi, vice president of Exor and recently appointed president of Comau, the subsidiary of FCA active in robotics that will be spun off from Lingotto before the merger with Peugeot and, subsequently, listed on the stock exchange as a stand-alone company.

In confirmation of this, it is not surprising that the branches of the family headed by these three cousins are those that have strengthened most in the recent reorganization of the shareholding of Giovanni Agnelli Bv. In fact, the rebalancing of the weights between the various branches of the dynasty saw Elkann's December further strengthen, going from 36% at the end of 2016 to the current 38%. With the result that the grandson of the lawyer Agnelli is even more firmly the first shareholder of the Dutch safe.

At the same time, the Eredi Umberto Agnelli branch grew, headed by Andrea Agnelli who became the second shareholder in the safe, rising to 11.85% surpassing the Eredi Maria Sole branch (now 11.63%). The branch represented by Alessandro Nasi also grew to 8.79%.

All this with all due respect to the minority branches of the family which in some cases did not fail to show their disappointment, especially after the reduction from 5.5 to 2.9 billion of the extraordinary dividend linked to the merger with Peugeot.

In short, on the eve of an historic merger for FCA, the family has chosen its structure for the future. And this despite one of the most recurring rumors of recent years in Turin's buildings was that John Elkann and Andrea Agnelli never had great harmony. Too different in character, the mantra repeated.

John Elkann and his wife Lavinia Borromeo.

Elkann, who grew up abroad, reserved far beyond the well-known Savoy understatement to the point of seeming almost distant. While Agnelli, on the other hand, is seen more as a typical exponent of the Turin who lives in the city center and does not disdain to be seen around, perhaps at the Del Cambio restaurant or at the Cavour bar (property, among other things, of another scion of the excellent Turin bourgeoisie, namely Michele Denegri of the family that controls Diasorin).

Explained: why is Ferrari not a part of FCA and PSA’s newly formed company Stellantis. Fiat Chrysler Automobiles (FCA) and Groupe PSA recently announced completing their 50:50 merger, forming a new company - Stellantis. However, the Italian sports car marque Ferrari is not part of the newly formed company. By Seshan Vijayraghvan. January 20, 2021.

Ferrari was officially separated from Fiat Chrysler Automobiles as a standalone brand in 2016.

Now it is true that, for the longest time, Ferrari was a part of Fiat Chrysler Automobiles. It was back in 1969 that Fiat S.p.A. acquired 50 per cent of Ferrari and, by 1988, the company expanded its stake to 90 per cent. However, much later, in October 2014, FCA showed intentions to separate Ferrari S.p.A. from under its umbrella and began the restructuring process a year later, in October 2015. This led to the formation of Ferrari N.V., a holding company of the Ferrari Group which was incorporated in the Netherlands, which was completed in 2016.

FCA held 90 per cent stakes in Ferrari by 1988, however in 2014 it showed intentions to separate it and, by 2016, Ferrari became a public company.

FCA sold 10 per cent of the shares in an IPO and concurrent listing of common shares on the New York Stock Exchange, whereas the remaining 80 per cent of shares was distributed among FCA shareholders. The remaining 10 per cent of Ferrari was and continues to be owned by Piero Ferrari, the son of the company's founder, Enzo Ferrari. Currently, a majority of shares in Ferrari are publicly owned, which stands at 67.09 per cent, 22.91 per cent is owned by Exor N.V., the holding company of FCA and 10 per cent is owned by Piero Ferrari.

At the same time, we also must understand that Ferrari holds a much higher value as a standalone brand. And, by keeping it that way, the shareholders will be able to maintain the higher value as opposed to making it a part of a larger conglomerate like Stellantis.

Explaining that aspect Arun Malhotra, Former MD Nissan India and auto industry expert, said: "there are two things I can say about this. One, Ferrari is a separate brand in itself, which has got a high intrinsic value. When you add too much into the merger you are locking (the) value, you will be able to unlock more value if you keep it out. And, second, the merger is happening with a similar type of technology and products. Ferrari's technology, product (and) profile, is in no way related. There's no relationship with the two merged companies in terms of their product profiles and in terms of their marketing strategies; it's a very niche brand."

Stellantis says it will now focus on potential markets like China, Africa, the Middle East, Oceania and India.

As for Stellantis, it currently covers the full spectrum of the automotive segment. Right from luxury, premium and mainstream passenger vehicles to hard-charging pickup trucks, SUVs and light commercial vehicles, as well as dedicated mobility, finance and parts and service brands, everything is under one brand. The company says it already has a well-established presence in three regions - Europe, North America and Latin America - and will now focus on potential markets like China, Africa, the Middle East, Oceania and India. Furthermore, it aims to launch 39 electrified vehicles by the end of 2021.

Who Owns Ferrari? Although every Ferrari has remained distinctly Ferrari since the day Maranello manufacturing facility opened its doors, the company has had a range of owners over the years. As of 2020, the public owns the majority of Ferrari.

With the public owning a majority stake in Ferrari, you can read it one of two ways: shareholders own Ferrari or Ferrari owns Ferrari. There’s not a wrong way to look at it, because either way it means that the people making the decisions about new Ferrari models, about how to register and catalog your classic Ferrari are all doing it with one thing in mind: the future of the Ferrari brand and reputation.

Originally housed under the Alfa Romeo brand, Enzo Ferrari broke free to establish his own company in 1939 and managed the business for over 20 years before pursuing outside investment opportunities. Conscious of the need to expand the industrial side of the business, Ferrari implemented a number of changes, including becoming a Limited Company in 1960.

Although there were other potential buyers, Fiat S.p.A. eventually acquired a 50% stake in Ferrari, allowing for a significant expansion in production. From 1969 to 1988 Fiat expanded its ownership from 50% to 90%, with Enzo Ferrari owning the remaining 10%. Upon Enzo’s death, his stake passed to Piero.

Ford attempted to purchase Ferrari but was denied when Enzo Ferrari learned he would lose control over the racing division. The stubbornness of Henry Ford II caused Ford to dive headlong into a racing competition with Ferrari that defined an era for both automakers.

While some automakers seem to change hands every few years, Ferrari has maintained its vision in part by remaining consistently managed. From the initial years to the FCA years to now there has been a consistent throughline to define a Ferrari and continue living up to the expectations of Chicago Ferrari drivers and Enzo himself.

Ferrari N.V. is the Dutch company that controls Ferrari S.p.A., the Italian car manufacturer founded by Enzo Ferrari in 1947 in Maranello that produces high-end sports and racing cars, being widely involved in world motor racing.

From 21 July 2018 the company, like the subsidiary Ferrari S.p.A., was led by Louis Carey Camilleri as managing director, while John Elkann is the president. Following the resignation of Louis Camilleri, which took place on 10 December 2020, John Elkann takes on the role of managing director on an interim basis. Both succeeded, a few days before his death, Sergio Marchionne, who had headed the company since 2014 when he replaced Luca di Montezemolo.

The company is listed on both the NYSE and the FTSE MIB index of the Milan Stock Exchange.

On 24 May 2013 Ferrari S.p.A., which became part of the Fiat Group in 1969, was incorporated into the Dutch company "New Business Netherlands N.V." which, from October 2015, was renamed "Ferrari N.V." and listed on the NYSE.

In September 2014 it was announced by Fiat Chrysler Automobiles, the automotive group born from the merger of Fiat S.p.A. (formerly known as Fiat Group) and Chrysler Group LLC, that Luca Cordero di Montezemolo would leave the presidency after 23 years at the conclusion of Ferrari's 60th anniversary celebrations in North America. Sergio Marchionne, former CEO of FCA, would come in his place.

On 21 October 2015, 10% of 90% of Ferrari N.V. owned by FCA is listed on Wall Street at an initial IPO price of $ 52.

From 4 January 2016, as announced at the end of October 2014, Ferrari N.V. is spun off from FCA through the assignment of a Ferrari N.V. share every 10 FCA shares owned by the shareholders of the former parent company and is also listed on the Italian Stock Exchange at an initial price of € 43.44, corresponding to a capitalization of € 8,709,204,596, thus passing under the direct control of Exor.

Ferrari is currently one of the world's leading luxury brands and deals with the design, production and sale of high-performance luxury sports cars. The Ferrari brand is a symbol of uniqueness, innovation, cutting-edge sports performance and Italian design. On 10 January 2020 Ferrari N.V. reached an all-time high of 157.50 euros per share, for a total capitalization of around 30.14 billion euros.

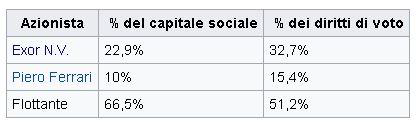

As of January 4, 2016, the shareholders of the company are the following:

|

Shareholder |

% of the share capital |

% of voting rights |

|

Exor N.V. |

22,9% |

32,7% |

|

Piero Ferrari |

10% |

15,4% |

|

Floating |

66,5% |

51,2% |

-

Exor and Piero Ferrari signed a shareholders' agreement, thus controlling 48.1% of the voting rights.

The Board of Directors in office in the three-year period 2017-2019 was composed of:

-

John Elkann (president)

-

Louis Carey Camilleri (CEO)

-

Piero Ferrari (vice president)

-

Delphine Arnault

-

Giuseppina Capaldo

-

Eddy Cue

-

Sergio Duca

-

Amedeo Felisa

-

Lapo Elkann

-

Maria Patrizia Grieco

-

Adam Keswick

This is the chronotaxis of the presidents of Ferrari N.V.:

-

Luca Cordero di Montezemolo (24 May 2013 - 13 October 2014)

-

Sergio Marchionne (13 October 2014 - 21 July 2018)

-

John Elkann (from 21 July 2018 - )

Although in 2013 it was decided to limit the number of cars produced to preserve their exclusivity and value over time, compared to a decrease in sales of 5.4% (6,922 cars), turnover rose to 2.3 billion euro (+ 5%), net profit reached 246 million euro (+ 5.4%) and the net industrial financial position was positive for 1.36 billion euro.

In 2014 turnover reached € 2.762 billion (+ 20%) thanks to an increase in sales of 4.8% (7,255 cars), net profit € 261 million (+ 6.1%) and operating income 389 million euros: all values never reached before.

2015 was a record year for the holding that achieves the best results ever, delivering 7,664 cars (+ 5.64%) and distributing a dividend of 46 cents per share for a total dividend of 86 million EUR. Revenues amounted to € 2.854 billion, an increase of 3% compared to last year, while profit increased by 9% to € 290 million compared to 2014. Earnings per share were equal to € 1.52 from € 1.38 in 2014. EBITDA rose from € 678 to € 719 million, while adjusted operating income was € 473 million, up 17% compared to 2014. Cash flow was positive for 390 million euros against 136 million in 2014, while net debt was equal to 1.94 billion euros.

On March 9, 2016, the company issued its first bond in history, collecting orders almost six times higher than the offer, for a total of 2.7 billion euros. The 500 million euro bond, unrated, has a duration of seven years, maturing on 23 March 2023, with a fixed annual coupon of 1.5% and a yield of 1.656%, having been issued at 98.977% of the nominal value.

Until 2012, sales were under the responsibility of the subsidiary Ferrari S.p.A.

|

Year |

Cars |

Variation |

|

2013 |

6922 |

- 5,41 % |

|

2014 |

7255 |

+4,81 % |

|

2015 |

7664 |

+5,64 % |

|

2016 |

8014 |

+4,60 % |

|

2017 |

8398 |

+ 4,80% |

|

2018 |

9251 |

+ 10,2% |

|

2019 |

10131 |

+ 9,5% |

About the Ferrari group. The Ferrari group is an Italian manufacturer specializing in luxury cars. Its activity concerns at the same time the design, manufacture and marketing of cars for individuals but also extends to racing cars, accessories and other derivative products.

The Ferrari group exports almost 90% of its production and is present in over 60 markets around the world. It has more than 200 dealerships abroad to its credit.

The Italian group Ferrari is one of the great names in motor sport and luxury in the world and, for this reason, it faces competition from various international brands that have been competing in this sector of activity for several years.

Rolls-Royce remains today the leader in this sector of the top of the range in terms of vehicle sales. It is immediately followed by the Bentley brand which occupies the second place in the world rankings. Ferrari ranks third in the world for sales. It is closely followed by Lamborghini, which ranks fourth in the world. Then Maserati in fifth position. Finally, Aston Martin and Bugatti occupy the sixth and seventh place respectively in the standings.

The Ferrari share price was listed for the first time on 23 October 2015, the date of the company's introduction on the stock exchange. The first price was $ 56.63 but it can be seen that, after this date, the price fell sharply passing below the $ 50 bar in November 2015.

In 2017, the total stock market capitalization of the Ferrari company rose to 1,907.13 million euros. The number of securities issued by the Ferrari company currently in circulation on the market is 964,695. The Ferrari share price is currently listed in Italy on the Electronic Share Market of the Italian Stock Exchange MTA. The Ferrari company is also part of the composition of the Italian national stock exchange index FTSE MIB and is therefore one of the Italian companies with the highest stock market capitalization.

The shareholding structure of the Ferrari company currently consists of 57.40% of floating assets, 23.50% of shares controlled by the company Exor, 10% of shares controlled by Piero Ferrari and 9.10 % of shares controlled by T Rowe Price Associates.

Here is some useful information about the economic and financial history of the Ferrari company with the dates that have marked the company in recent years.

In 2004 Luca Cordero di Montezemolo was appointed to the head of the Ferrari group.

In 2005 Ferrari sold 5,399 cars. In 2006 it sold 5,743 of them, which constitutes an increase in turnover of the order of 17%. Ferrari has always refused to produce and sell more vehicles, despite strong demand from dealers, having chosen to favor artisanal over industrial manufacturing.

In 2006 the group made a purchase offer of 800 million euros to Mediobanca to recover 29% of the Ferrari group, thus bringing its control to 85%. A further 5% had already been sold by the bank to Abu Dhabi's Mubadala investment fund.

In 2014, the FCA group (Fiat Chrysler Automobiles) announced its intention to separate itself from Ferrari by introducing 10 to 20% of this company on the stock market. The rest of the securities would then be distributed to the shareholders of the FCA group. The group hopes to free up € 2.25 billion through this operation.

In 2015, the demerger between the manufacturer Fiat Chrysler Automobiles and Ferrari was approved by the shareholders. As part of this operation, FCA decides to transfer the Ferrari shares to the company FE Interim. The demerger will take effect in January 2016.

At the beginning of 2016, Ferrari was no longer part of the Fiat group. It supplied engines and paints for the bodywork of Maserati, another former subsidiary of the group. We recall, in fact, that in 2002 Fiat had already sold 34% of the shares of Ferrari to Mediobanca for a total amount of 775 million euros.

The Ferrari brand has a long history and therefore has a heritage and a certain recognition in its sector of activity which today represent its main strength. The brand value of Ferrari is in fact one of the strongest in this sector as it is considered by the general public as a cult brand and synonymous with quality and excellence.

Another strength of the Ferrari group is its strong presence in the motor racing sector. Thanks to its important presence at major championships and international meetings Ferrari further strengthens its visibility in the world and gains more and more the trust of consumers while, at the same time, seducing fans of motorsports. This also allows Ferrari to demonstrate its technological innovation capabilities and performance.

It must be said that Ferrari's innovation abilities are also one of the strengths of this company which manages a cutting-edge design service and invests heavily in research and development to go further and further in the design of its engines and its luxury vehicles. Buyers of these cars particularly appreciate the brand's efforts to equip their vehicles with ultra-light alloys that offer more effective acceleration and better handling than most of its competitors.

Ferrari has also recently invested a lot of energy in setting up a program dedicated to second-hand sales. It therefore no longer limits itself to marketing its new vehicles to order but now reaches all customer segments, thus obviously being able to increase profits.

Another advantage of this company concerns the low expenses made in the field of marketing and advertising. Thanks to its worldwide fame, in fact, the brand is today a source of inspiration and cars are one of the most coveted in the world. As a result, Ferrari realizes some interesting savings in terms of communication.

Finally, it should also be noted that the Ferrari group does not just sell sports and luxury vehicles but also offers a number of derivative products which prove to be very lucrative, such as perfumes, clothing or models of its vehicles.

Customs policies in some countries severely curb Ferrari sales in certain areas of the world. The complexity of the import practices of these vehicles leads in fact to lengthening the procedures and this can hold back some buyers.

Ferrari also has to face the increasingly demanding and meticulous expectations of its customers and it must be said that the group is not always able to satisfy these requests.

Finally, competition remains an important negative point for the company due to the opponents who increase their efforts to steal market shares.

Ferrari becomes a publicly traded company. Fiat Chrysler Automobiles will still retain an 80 per cent share in Ferrari. October 22, 2015.

Ferrari drove onto the New York Stock Exchange and its shares, trading under the ticker symbol RACE, jumped sharply in their public debut.

John Elkann and Piero Lardi Ferrari.

The automaker, based in the northern Italian town of Maranello, had been a private company since its founding in 1929 by Italian sports driver Enzo Ferrari.

Gianni Agnelli and Enzo Ferrari.

In 1969 Fiat bought a 50 per cent stake in the company, which it then increased to 90 per cent in 1988.

For Fiat-Chrysler (the companies joined last year) the IPO raises needed cash and also helps pare debt at the world's seventh largest automaker, which has ambitious plans to expand its Alfa Romeo brand and other higher-margin luxury cars like Maserati.

There were questions, however, about how becoming a public company might affect such an iconic brand.

IHS Automotive, the consulting firm, said some filings suggest Ferrari might boost production from between 7,000 and 8,000 cars per year, to 9,000 by 2019.

IHS acknowledged that it did not know if the company would devote any new production to higher-end models that cost well in excess of $200,000 which already exceed demand or, like in the late 1960s and early 1970s, it would again start making lower-priced models to put the Ferrari within reach of more people.

"Whatever the strategy it chooses to enact, it will be keen to maintain the combination of mystique and profit-generating ability of this business," said Ian Fletcher, an IHS analyst.

In an interview with CNBC from the floor of the NYSE Sergio Marchionne, CEO of Fiat Chrysler Automobiles and chairman of Ferrari, said he would not allow increased production to threaten the Ferrari tradition.

"What is at the heart of the brand is this intimate relationship between us and the customer base. We have 60 per cent of the people that buy our cars every year are returning customers,"Marchionne said."And therefore it would be almost suicidal to try to expand volumes to the detriment of that relationship."

Fiat Chrysler Automobiles will still retain an 80 per cent share in Ferrari. It plans distribute Ferrari stock to its shareholders next year.

The remaining 10 per cent belongs to the Ferrari family.

The IPO, even in what has become a dodgy market with doubts about the economic recovery seeping into the minds of investors, raised more than $893 million this week.

A number of companies in recent weeks have cancelled IPO, fearing the market malaise.

But investors clamoured for a piece of one of the world's premier automakers, erasing doubts about the allure of holding its stock.

Shares of Ferrari climbed almost 6 per cent to close at $55 while the broader markets edged lower.

The initial public offering of common shares of Ferrari N.V. (“Ferrari”) occurred on October 21, 2015 at USD 52 per common share (IPO price range: USD 48 – 52 per common share) on the New York Stock Exchange (“NYSE”). On January 4, 2016 the common shares of Ferrari were listed at EUR 43 per common share on the Mercato Telematico Azionario (“MTA”) organized and managed by Borsa Italiana S.p.A. following the spin-off of the Ferrari business from Fiat Chrysler Automobiles N.V. ("FCA").

The share capital of Ferrari amounted to €2,573 thousand, consisting of 193,923,499 common shares and 63,349,111 special voting shares, all with nominal value of €0.01 per share, as of December 31, 2019. At the same date, Ferrari held 8,640,176 common shares and 2,190 special voting shares in treasury.

Since January 3, 2016, the day on which the Merger (as defined in the Special Voting Shares – Terms and Conditions) became effective, the terms and conditions attached to this page apply to the issuance, allocation, acquisition, holding, repurchase and transfer of special voting and common shares in the share capital of Ferrari N.V., a public company under Dutch law having its official seat in Amsterdam, the Netherlands, registered with the Dutch trade register under number 64060977.

Ferrari debuts on Milan stock exchange. Ferrari debuted on the Milan stock exchange, with the stock dropping slightly compared to its opening value. But strong sales and net profit figures for recent quarters suggest the sports-car maker remains in good shape. 4 January 2016.

Ferrari, the Italian maker of luxury status-symbol sports cars, debuted on the Milan stock exchange on Monday, three months after the initial public offering (IPO) of its shares on the New York Stock Exchange (NYSE). The shares fell 3.5 percent from their Monday opening value of 43 euros ($46.72), down to 41.50 euros per share, before recovering to slightly above their opening value in the course of trading.

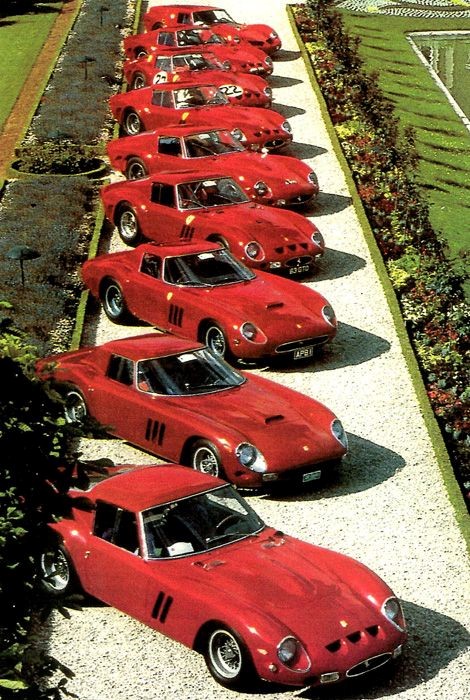

Eight Ferrari racing-cars were parked in front of the Milan stock exchange for the opening. Ferrari is the only race-car maker that has continuously participated in Formula 1 racing since the beginning.

On Friday afternoon, the shares had closed at $48 on the NYSE, about 43.95 euros.

The flat price on the stock's opening day in Milan contrasted with its exuberant start after the IPO in New York three months ago, where shares rose as high as 53 euros on the first day of trading - 15 percent above their opening value.

Ferrari was until recently a subsidiary of Fiat Chrysler, which decided in 2014 to spin out the sports-car maker by making it a separate company. It has now completed the process.

This past autumn, Fiat Chrysler sold about 10 percent of Ferrari shares to investors through Ferrari's NYSE debut and it has now distributed another 80 percent to investors through the Milan listing.

Ten percent of Ferrari's shares - and 15.8 percent of voting rights - remained in the ownership of Piero Ferrari, son of Enzo Ferrari, the founder of the carmaking company. The heirs of Fiat's founder, the Agnelli-Elkann clan, bought 23.5 percent of Ferrari's shares and secured 33.4 percent of voting rights. Together, the Ferrari and Agnelli-Elkann families own nearly 49 percent of voting rights, with which they aim to maintain the "stability" of the Ferrari brand.

Sales of the sports cars remained robust, with revenues up by 9 percent in the third quarter and net profits up 62 percent. Ferrari sold about 7,000 new cars in 2015 and plans to increase production to 9,000 by 2019, the company has said.

The spin-out of Ferrari from Fiat Chrysler caused a one-third drop in Fiat Chrysler's share price, to 8.54 euros per share on Monday. This doesn't mean Fiat Chrysler took a hit, however: now that the previous parent company no longer owns Ferrari, it is appropriately worth a lower amount.

Despite the split in ownership, Fiat Chrysler chief Sergio Marchionne will remain head of Ferrari as well. The Italian-Canadian executive has been pursuing a major restructuring plan for Fiat Chrysler, with a key goal of seeking a fusion with a larger carmaker now that Ferrari has been spun out. He has argued strongly in favor of fusing Fiat Chrysler with General Motors (GM), but GM's management has so far spurned his entreaties. nz/hg (AFP, Reuters).

EVALUATION REPORT OF “FERRARI Spa”. 1.03.2016.

INTRODUCTION

Short story.

Ferrari S.p.A. is an Italian car manufacturer founded by Enzo Ferrari in 1947 in Maranello in the Province of Modena. It produces high-end sports and racing cars, being extensively engaged in world motorsport.

Ferrari celebration for 1000 Grand Prixs in Formula 1.

It is the most successful in the Formula One World Championship, where it has won 15 Drivers' and 16 Constructors' titles and one of the most successful in competitions for Sports, Prototype, Sport Prototype and Gran Turismo cars such as the World Sport Prototype Championship, with 12 obtained Constructors' titles and the FIA World Endurance Championship, where it holds 4 GT Constructors' titles and 2 GT Drivers’. It has made a name for itself several times in Endurance Classics such as the 24 Hours of Le Mans, the 12 Hours of Sebring and the 24 Hours of Daytona and in road races such as the Targa Florio, the Mille Miglia and the Carrera Panamericana.

Quotation

In 2015, FCA put 10% of its Ferrari shares up for sale as part of an Initial Public Offer and, on 21 October 2015, Ferrari was admitted to listing on the New York Stock Exchange; the 10% is listed on Wall Street at an initial IPO price of $ 52. From 4 January 2016, as announced at the end of October 2014, Ferrari N.V. is spun off from FCA through the assignment of a Ferrari N.V. share every 10 FCA shares owned by the shareholders of the former parent company and is also listed on the Italian Stock Exchange at an initial price of 43.44 euros, corresponding to a capitalization of 8,709,204,596 euros, thus becoming an independent company. The code chosen for listing on the NYSE and MIB is RACE which, as Sergio Marchionne explains in the 2015 “Letter to Shareholders”, serves to remind them of the origin which, beyond the sale of cars, is precisely the race.

The reasons that led the FCA group to spin off Ferrari are mainly related to the listing of the FCA stock on the NYSE.

The American market remained indifferent to the listing of the group born from the merger of Fiat and Chrysler and FCA needed to put back into circulation the securities returned to the company by the shareholders who opposed the merger. Since the spin-off took place through the assignment of 1 share for every 10 FCA shares, Exor NV, a Dutch company controlled by the Agnelli heirs, remains the majority shareholder and, through a shareholders' agreement entered into with Piero Ferrari and the multiple voting mechanism (granted to shareholders who have held the shares for a certain period of time), controls 48.8% of the voting rights.

Shareholder structure

OVERVIEW

The Industry and the Market

Currently we are in a phase of world economic expansion (global growth is estimated by the International Monetary Fund of 3.1% in 2016 and 3.4% in 2017), in the USA the pre-crisis values have been exceeded while in the Eurozone it’s getting closer.

The automotive industry represents the driving force for growth for the economies of the main production areas, which through it have created value, have generated positive effects on trade balances and have driven many other industrial sectors by creating direct and indirect employment. However, this development not only presents inhomogeneity but is characterized by continuous changes and contradictions. In fact, from a geographical point of view, a shift in production volumes has taken place from the areas of the most ancient automotive tradition, conditioned by the saturation of the markets and the excess of production capacity, towards new areas in favor of which demographic and economic development factors play a role, as well as low production costs. From 2007 to 2015, the world demand for motor vehicles, which increased by 25% (from 71.7 million units to 89.7), has changed enormously: industrialized and "motorized" countries, historically areas of production, have seen the weight of their markets reduce going from 57% of share to 45% while the BRIC countries (Brazil, Russia, India and China), whose demand grew by 98% compared to 2007, reached 36% of world sales. In particular, the last 22 months have been quite lively with double-digit growth, with the only slowdown recorded in July. 2016 had two speeds (from a study by Euler Hermes, a company of the Allianz group), growing in China, the United States and part of Europe, falling in Brazil and Russia, slowing in Japan and Turkey, stopped in India.

The Company and Businesses

Ferrari is an automotive company that deals with three businesses: the production of high-end sports cars (70.2% of revenues), competing in Formula 1 races and the sale of products with the Ferrari brand (together (15.7 %), the sale of engines to Maserati (10.9%) and other secondary activities.

The design, engineering and production of the cars take place in Maranello and cars are sold in 60 markets around the world, through a network of 170 authorized dealers and 188 points of sale. The market share in 2016 in the sports car industry is 22%, the company's positioning is in luxury, the competition in the reference segment is limited to a few subjects (Aston Martin, Audi, Bentley, Lamborghini, McLaren, Mercedes Benz, Porsche and Rolls-Royce). The cars produced must be state-of-the-art, equipped with the best technologies and potentially trying to anticipate trends to satisfy the demanding tastes of the target in compliance with standards and legislative limitations. The production takes place through ordering (minimizing the working capital) and is limited to a few hundred units per model to keep the product exclusive, still pursuing the principle of Enzo Ferrari for production: "one car less than what the market requires". In product development, they are firm in the belief that every new car they develop should be "best in class". This company philosophy has ensured that many models produced in 2015 and 2016 were sold out before the announcement was even made. The demand is robust and growing for the Ferrari product, the planning for production is increasing in the coming years if market conditions allow it. 2016 closed with the sale of 8014 cars, an increase of 8.8% compared to the previous year. The main markets are the United States and Canada (33.5%), the European Union (30.5%), China (7.7%). Another production area that is experiencing great success is the recent customization area, in particular the Tailor-Made program, which allows the customer to create his own car, also using materials completely unknown in the automotive world thus leading to the creation of unique models.

The activities related to the sale of products with the Ferrari brand are carried out through partnerships with dominant companies in their sector, that are as follows: Oakley eyewear; Tod's shoes and leather; Electronic products; Puma sportswear; Theme parks: Ferrari World (Abu Dhabi), Ferrari Land (Port Aventura); toys: Bburago (play-set), Lego (Lego toys); video games: Electronic Arts, Microsoft, Sony Polyphony, Ubisoft; Hublot watches (co-branded), Movado (Scuderia Ferrari Watches).

The Brand

In 2013 and 2014 the Ferrari brand was recognized as the most influential in the world. In 2016 it was estimated as the 9th most valuable in the European Union and 258th in the world, or 4.41 billion dollars. The emotion and media attention generated by the IPO are an undeniable testimony of the strength of the Ferrari brand. Prestige, success, exclusivity, world-class craftsmanship, intrinsic value, unmistakable design - these are all attributes associated with the Ferrari brand. The Brand turns out to be much more than a car company and a Formula 1 team, it is the very definition of a luxury brand.

The brand and its enhancement are one of the company's priorities, since the brand is the main driving force for sales and the perception of the brand is closely linked to Ferrari's results in Formula 1 races.

Formula 1 is the key element of the marketing strategy, since victories are the demonstration in the eyes of customers of superior technology.

The product

From an analytical point of view, the Ferrari product has two main characteristics: belonging to the automotive sector - an extremely cyclical sector and therefore strongly conditioned by the trend of the global economy - and positioning itself as a luxury item. The latter element would accentuate the volatility of corporate performance with respect to the trend of the economy. Being a luxury product quality must be the focus, the search for new materials and the invention of new technologies are necessary to maintain the positioning; all this entails high and constant Research and Development costs. The results during times of economic depression are harmonized by the strength of the brand, which provides a significant competitive advantage over competitors in the same market segment.

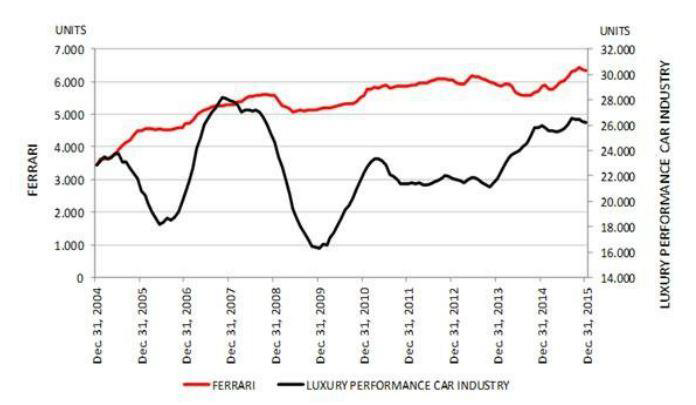

The graph shows the units sold by Ferrari compared to the main competitors in the luxury sports car market (Aston Martin, Audi, Bentley, Lamborghini, McLaren, Mercedes Benz, Porsche and Rolls-Royce). The linearity of Ferrari's sales compared to its competitors is the result of the strength of the Brand and of the corporate strategy which, by limiting production, makes sales gradually increasing and constant (even if this risks to limit their potential).

INCOME STATEMENT

|

% on revenues |

2016 |

2015 |

2014 |

2013 |

2012 |

||||||||||

|

Total revenues |

100% |

3.105 |

2.854,4 |

2.762,4 |

2.335,3 |

2.225,2 |

|||||||||

|

Cost of sales |

50,9% |

1580 |

1.498,8 |

1.505,9 |

1.234,6 |

1.198,9 |

|||||||||

|

Gross profit |

49,1% |

1525 |

1.355,6 |

1.256,5 |

1.100,6 |

1.026,3 |

|||||||||

|

General administrative and sales expenses |

9,5% |

295 |

338,6 |

300,1 |

259,9 |

242,8 |

|||||||||

|

Research and development costs |

16,4% |

509,6 |

446,7 |

415,3 |

358,8 |

333,5 |

|||||||||

|

Writedowns / depreciation |

3,4% |

104 |

114,9 |

125,5 |

120,4 |

97,9 |

|||||||||

|

Non-operating net financial incomes and expenses |

-- |

-- |

-- |

-- |

-- |

-- |

|||||||||

|

Extraordinary expenses |

-- |

-- |

-- |

-- |

-- |

-- |

|||||||||

|

Other operating expenses |

0,4% |

29 |

11,0 |

26,1 |

-2,1 |

16,5 |

|||||||||

|

Total operating expenses |

84.,3% |

2477,6 |

2.410,0 |

2.372,9 |

1.971,7 |

1.889,7 |

|||||||||

|

Operating income |

20,21% |

627,4 |

444,3 |

389,5 |

363,5 |

335,5 |

|||||||||

|

Net financial incomes and expenses |

-0,9% |

-28 |

-10,2 |

8,8 |

2,9 |

-0,9 |

|||||||||

|

Gain (loss) on the sale of goods |

-- |

-- |

-- |

-- |

|||||||||||

|

Other net components |

-- |

-- |

-- |

-- |

|||||||||||

|

Pre-tax result |

19% |

595,4 |

434,2 |

398,2 |

366,4 |

334,6 |

|||||||||

|

Provisions for income taxes |

5,04% |

167 |

144,1 |

133,2 |

120,3 |

101,1 |

|||||||||

|

Net result after taxes |

13,93% |

432,4 |

290,1 |

265,0 |

246,1 |

233,5 |

|||||||||

|

Net result under the responsability of third parties |

0,08% |

-2,2 |

-3,6 |

-5,3 |

-8,1 |

||||||||||

|

Net result excluding extraordinary items |

10,08% |

287,8 |

261,4 |

240,8 |

225,4 |

||||||||||

|

Net income |

10,08% |

287,8 |

261,4 |

240,8 |

225,4 |

||||||||||

Analysis

- The Ferrari income statement is clear and clean. The mark-up of over 49% and the gross margin of 20% in 2016 confirm what has been said about Ferrari's competitive advantage, thanks to communication, the power of the brand and the corporate strategy. The trend is constantly growing for the years under consideration - previous data are not made public but, considering the data used for the graph in the paragraph "The Product", we can easily infer a growing trend of sales in the core-business in the last 12 years, which remains almost indifferent also to the 2009 financial crisis.

- Research and development costs are also increasing, however, unlike other costs, they are to be considered an investment to be amortized over the years, as the results achieved by the team of engineers and technicians will be subject of intellectual properties that will generate income in the future. In fact, the amortization of 104 corresponds to the amortization of research and development costs of previous years.

- Net financial charges have increased in recent years but remain by an absolutely negligible amount as they are 4.46% of EBIT, for an interest coverage ratio of 22.4. The negative interest that Ferrari pays on the debt is offset by the interest income of the financial part of the company, which finances customers for the purchase of the machines. Therefore, considering only the income statement, the debt situation is good and the risk of default is almost absent.

- The average tax rate is 36.3%.

The available data make it clear that the end of 2016 is certainly positive and an improvement compared to 2015, revenues increased by 8.8% and EBIT by 10%. In conclusion, the results for the year demonstrate the solidity of the company and its leadership in the reference market. With a very good profitability and, thanks to the production strategy, not influenced (at least for the available data) by the market phases.

BALANCE SHEET

|

2016 |

2015 |

2014 |

2013 |

||||

|

Cash |

-- |

-- |

-- |

||||

|

Cash and equivalent means |

457,8 |

182,8 |

134,3 |

113,8 |

|||

|

Current financial assets |

13 |

3,6 |

-- |

-- |

|||

|

Total availability and current financial assets |

469,8 |

186,3 |

134,3 |

113,8 |

|||

|

Net trade receivables |

1.034,35 |

1.332,00 |

1.408,10 |

1.068,70 |

|||

|

Total credits |

1.074,35 |

1.373,00 |

1.448,10 |

1.099,80 |

|||

|

Inventories |

324 |

295,4 |

296 |

237,5 |

|||

|

Prepayments and accrued income |

-- |

20 |

14,2 |

8,7 |

|||

|

Other current assets |

565,4 |

145,1 |

952,1 |

759,1 |

|||

|

Total current assets |

2.333,40 |

2.019,80 |

2.844,70 |

2.218,90 |

|||

|

Gross tangible fixed assets |

2376,6 |

2.266,00 |

2.120,20 |

1.966,30 |

|||

|

Accumulated depreciation fund |

-1.707,3 |

-1.603,30 |

-1.499,40 |

-1.361,80 |

|||

|

Net tangible fixed assets |

669,3 |

626,1 |

620,8 |

604,5 |

|||

|

Goodwill |

785,2 |

787,2 |

787,2 |

787,2 |

|||

|

Intangible assets |

354,4 |

307,8 |

265,3 |

242,2 |

|||

|

Long-term investments |

33,9 |

11,8 |

11,9 |

1,3 |

|||

|

Long-term active effects |

-- |

-- |

-- |

-- |

|||

|

Other long-term assets |

119,4 |

122,6 |

111,7 |

41,5 |

|||

|

Total assets |

3.849,60 |

3.875,40 |

4.641,40 |

3.895,50 |

|||

|

Commercial debts |

614,88 |

507,5 |

535,7 |

485,9 |

|||

|

Payables / accruals and deferrals |

-- |

-- |

-- |

-- |

|||

|

Accrued liabilities and deferred income |

135,4 |

112,6 |

127,6 |

64,6 |

|||

|

Bills of exchange / short-term payables |

0 |

0 |

0 |

0 |

|||

|

Other financial liabilities |

-- |

-- |

491,3 |

296,8 |

|||

|

Other current liabilities |

763,7 |

588 |

564,4 |

462,9 |

|||

|

Total current liabilities |

1.514,00 |

1.208,20 |

1.719,00 |

1.310,20 |

|||

|

Financial debts |

1.848,04 |

2.260,40 |

18,9 |

20,5 |

|||

|

Fees for capital lease |

-- |

-- |

-- |

-- |

|||

|

Total financial debts |

1.848,04 |

2.260,40 |

18,9 |

20,5 |

|||

|

Total liabilities |

1.848,04 |

2.260,40 |

510,2 |

317,3 |

|||

|

Deferred taxes |

13,1 |

23,3 |

21,6 |

28 |

|||

|

Net result under the responsibility of third parties |

4,8 |

5,7 |

8,7 |

26,8 |

|||

|

Total various liabilities |

335,7 |

402,9 |

403,6 |

220,5 |

|||

|

Total liabilities |

3.715,64 |

3.900,50 |

2.171,80 |

1.606,00 |

|||

|

Total capital |

2,5 |

3,8 |

3,8 |

3,8 |

|||

|

Additional paid-up capital |

-- |

-- |

-- |

-- |

|||

|

Retained reserves and net profit |

302,34 |

-12,1 |

2.503,60 |

2.242,30 |

|||

|

Treasury shares |

-- |

-- |

-- |

-- |

|||

|

Unrealized gains / losses |

-- |

-- |

-- |

-- |

|||

|

Other equity components |

20,16 |

-16,8 |

-37,8 |

43,4 |

|||

|

Net assets |

325 |

-25,1 |

2.469,60 |

2.289,50 |

|||

|

Total liabilities and equity |

3,849,60 |

3.875,40 |

4.641,40 |

3.895,50 |

|||

|

Total outstanding ordinary shares |

188,92 |

188,92 |

188,92 |

188,92 |

|||

Analysis

- Cash and cash equivalents increase every year, amounting to 457.8 million euros in 2016, it is good news to know that the company has a buffer to deal with any eventuality.

- It should be noted that 2014 closed with a significant increase in trade receivables of 40% against an increase in revenues of 18.3%. The non-proportional increase in trade receivables compared to the increase in revenues is a clear signal that the company wanted to inflate revenues in the income statement (and consequently the profit) avoiding cashing in, significantly increasing the working capital. Probably this choice was implemented in anticipation of the listing on the NYSE, which took place in the following months, to ensure that during the IPO the value of the share was as close as possible to the upper limit of the fork. In any case, trade receivables decreased over time until the end of 2016 (from the end of 2014 - 26%), reaching the lowest value of all the years disclosed. This reduces working capital for the benefit of cash flow, which portends a more prosperous near future.

- Trade payables float around 500 million every year despite the growth of the company and production, a sign of an aversion to short-term exposure to suppliers.

- The inventories 324 are attributable for 168.08 million to raw materials and semi-finished products, therefore they do not lose value over the years unlike the remaining 155.9 which concerns finished and unsold products. As these are sports, luxury and high-tech cars, just like technology they can be subject to rapid devaluation. In any case, inventories remain constant over time and tend to vary very little despite the increase in revenues, an excellent sign also made possible by the production policy (on order).

- Ferrari owns various properties, plants and machineries for a total of 2.3 billion euros (purchase value), including the Maranello circuit.

- Intangible assets are written for 354 million euros but, as highlighted in the paragraph “The Brand”, only the “Ferrari” brand is currently valued at 4.4 billion dollars without considering the patents which have a considerable value.

- Financial debt: the debt of 2.2 billion in 2015 is almost totally (99%) negotiated with a syndicate of 10 banks. These debts had a maximum maturity of 5 years. Much of the exposure (63%) was generated by a single loan agreement in Euro currency with an interest rate of Euribor 3m + 90 basis points, currently 1.23%. The latter was done towards the end of 2015 and, together with another contract (22%), was used to repay the debt to FCA (see next point). In 2016, the company reduced the total amount of debt to a value of 1.8 billion and part of this debt to banks (500 million) was refinanced with a bond with a maturity of 7 years and conversion obligation.

- The 2015 change in "retained reserves and net profit" is due to the separation from FCA, as these profits were generated and reinvested in the company during the period of control of the Fiat group which owned 90% of the share capital. At the time of the demerger Ferrari had to borrow money to distribute these profits.

In conclusion, the balance sheet is sound. Cash on hand is important, the level of trade debts and credits is very controlled and the debt to banks is not worrying (D / E ratio at market values 0.148).

FINANCIAL STATEMENT

|

2016 |

2015 |

2014 |

2013 |

2012 |

|||||||

|

Profit / loss for the year |

567.35 |

434,2 |

398,2 |

366,4 |

334,6 |

||||||

|

Write-downs |

247,71 |

274,8 |

289 |

270,2 |

237,5 |

||||||

|

Depreciations |

-- |

-- |

-- |

-- |

|||||||

|

Deferred taxes |

-- |

-- |

-- |

-- |

|||||||

|

Change in non-monetary items |

46,41 |

80,1 |

118,9 |

54,7 |

77,8 |

||||||

|

Change in working capital |

395,85 |

-81,8 |

-380 |

-237,3 |

-187,4 |

||||||

|

Liquidity from operational activities |

1.005,3 |

707,3 |

426,1 |

454 |

462,5 |

||||||

|

Investments in tangible fixed assets |

-342 |

-355,9 |

-330 |

-270,9 |

-258,4 |

||||||

|

Other monetary investment activities (other changes in net assets) |

21,53 |

38,9 |

40,2 |

3,6 |

0,7 |

||||||

|

Liquidity from investment activities |

-320,46 |

-317,1 |

-289,8 |

-267,3 |

-257,6 |

||||||

|

Monetary financing activities |

x |

2.458,90 |

-173 |

-176,9 |

-226,8 |

||||||

|

Dividend distribution |

104,1 |

-- |

-- |

-- |

-- |

||||||

|

Net capital increases |

1,4 |

-- |

-- |

-- |

-- |

||||||

|

Net change in financial assets / liabilities |

x |

2.107,60 |

51,4 |

13,4 |

32,5 |

||||||

|

Liquidity from financial activities |

-411,0 |

-351,3 |

-121,6 |

-163,5 |

-194,4 |

||||||

|

Difference from foreign exchange rates |

1,23 |

9,5 |

5,8 |

-9,5 |

-4,4 |

||||||

|

Total liquidity generated (absorbed) |

275,03 |

48,5 |

20,5 |

13,7 |

6 |

||||||

|

Interests paid |

-- |

-- |

-- |

-- |

|||||||

|

Income taxes paid |

252,03 |

145 |

140,9 |

138,8 |

134,3 |

||||||

Analysis

- 2016 ends with a cash flow from operating activities of 1,005, up by 30%, growth largely due to the increase in profit and the reduction in working capital mainly from the collection of receivables.

- The liquidity absorbed for investments is 320, these are investments necessary to keep the company competitive, therefore they are to be considered necessary and perpetual.

- The liquidity absorbed by the financial activity is 411, the cost that the company bears for the separation from FCA.

Free cash flow is 275.

RATING

All this information documented so far served to answer three fundamental questions for the evaluation process of a company: 1) How profitable is the company? 2) How long will it continue to be? 3) Is there a risk that profitability will deteriorate or is there an opportunity that will improve?

Despite the extremely cyclical market in which it is located, the company has shown that market phases have little influence on the business, in twelve years of data there is no evidence of a deterioration in sales not even in the financial crisis of 2009, thanks to the Pull strategy production. Competition is also not a danger, since the company presents itself with a distinct and prestigious identity. We will consider the increasing flows over time, making a conservative estimate so that surely the final value will never overestimate the reasonable value of the investment.

Ferrari proves to be a transparent and clear company which has a material but above all intangible heritage of very high value and it is precisely the heritage that guarantees constant and growing flows. The debt situation is not worrying and destined to last a short time given Ferrari's philosophy and its aversion to debt. For this reason, in the evaluation we will not consider the existing assets but the cash flows they will generate, thus avoiding counting them twice.

Ferrari proves to be a leader in the segment it aims to, there are no signs of deterioration in profitability. The risk components are low, this allows us to feel comfortable using a discount rate for future cash flows between 8% and 9%.

Using the cash flow of 2016 as a reference and subtracting the part necessary to keep the company competitive we obtain 685 million euros, money theoretically available to investors but that the company uses in various activities reinvesting it internally and, therefore, increasing the future shareholder value. Assuming a constant growth of 8% for the first ten years and then growing at the same pace as the world economy and the aforementioned discount rates we obtain a unit value per share in a range between € 99.77 and € 81.87. The value is not exact but a range because it is based on predictions. In any case, the intrinsic value of a single stock, according to our calculations and our logic, is within this range.

At the time of writing the share is quoted at € 62.60, a price it reached with a rally that in recent months has increased its value by over 70%. The market has recently realized the potential of this title which, in our opinion, is still undervalued and to be considered an excellent investment. Over a medium-long time horizon, if you invest at this price you will generate a gross increase of between 31% and 55% of the invested capital.

Shareholders of Ferrari (NYSE: RACE) must be delighted with their 456% total return. By simply Wall Street. Published January 25, 2021.

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. To wit, the Ferrari N.V. (NYSE:RACE) share price has soared 433% over five years. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 14% over the last quarter. But this could be related to the strong market, which is up 17% in the last three months.

View our latest analysis for Ferrari

To quote Buffett, 'ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

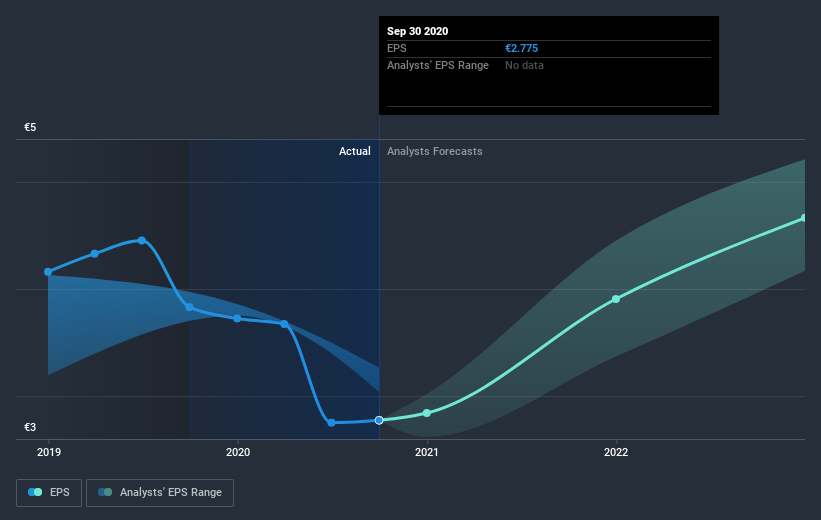

During five years of share price growth, Ferrari achieved compound earnings per share (EPS) growth of 11% per year. This EPS growth is lower than the 40% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth. This optimism is visible in its fairly high P/E ratio of 62.79.

You can see how EPS has changed over time in the image below.

NYSE: RACE Earnings Per Share Growth January 25th 2021.

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Ferrari's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Ferrari's TSR for the last 5 years was 456%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Ferrari provided a TSR of 24% over the last twelve months. But that return falls short of the market. On the bright side, the longer term returns (running at about 41% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. I find it very interesting to look at share price over the long term as a proxy for business performance.

The company at a glance. Il Sole 24 Ore, 24.02.2021. Ferrari is one of the world's leading luxury brands and deals with the design, production and sale of high-performance luxury sports cars. The Ferrari brand is a symbol of uniqueness, innovation, cutting-edge sports performance and Italian design. The history and image of Ferrari cars are closely linked to the Scuderia Ferrari Formula 1 team. Ferrari designs and manufactures its vehicles in Maranello (MO).

Company profile

Registered office

Via Abetone Inferiore, n. 4 - 41053 – Maranello, Italy

Turnover (in Eur) 1.503.010

Net income (in Eur) 174.947

Number of employees (2020) 4.402

Shares

|

ORDINARY |

193.923.499 |

|

OTHERS |

56.497.618 |

|

Total |

250.421.117 |

Major shareholders

|

Shares held on their own |

3.44 |

|

Blackrock Inc. |

6.10 |

|

Exor (voting rights 35,8%) |

24.00 |

|

Market |

51.56 |

|

Piero Ferrari (voting rights 15,2%) |

10.20 |

|

T. Rowe Price Associates Inc. |

4.70 |

Balance sheet data

EBIT

2019 2018 2017 2016 2015 2014 2013 2012 300k 400k 500k 600k 700k 800k 900k 1M

Net financial position

2019 2018 2017 2016 2015 2014 2013 2012 -2.5M -2M -1.5M -1M -500k 0500k 1M

Summary of the consolidated financial statements (thousands EUR) |

||||

|

30/6/2020 |

30/6/2019 |

31/12/2019 |

31/12/2018 |

|

|

REVENUES FROM SALES AND SERVICES |

1.503.010 |

1.923.660 |

3.766.615 |

3.420.321 |

|

EBITDA |

439.150 |

623.816 |

1.265.870 |

1.112.590 |

|

EBIT |

243.393 |

471.047 |

917.446 |

826.507 |

|

GROUP RESULT |

174.947 |

360.395 |

695.818 |

784.678 |

|

NET INCOME |

175.200 |

363.667 |

698.708 |

786.627 |

|

Cash Flow [Profit + Depreciation] |

373.415 |

517.826 |

1.050.654 |

1.075.375 |

|

TOTAL SHAREHOLDERS 'EQUITY |

1.346.702 |

1.383.083 |

1.487.288 |

1.353.839 |

|

NET FINANCIAL POSITION |

-1.645.389 |

-1.166.987 |

-1.191.791 |

-1.133.503 |

RESULTS AT 30 JUNE 2020 - The Covid-19 effect impacts Ferrari's second quarter results and the first six months of 2020 closed with a double-digit decline of results. In the three months April-June 2020 the cars delivered to the network almost halved compared to the previous year, going from 2,671 to 1,389 units (- 48%) essentially due to the restrictive measures imposed to deal with the pandemic, including the suspension of the production activity and the closure of dealers. As a result sales of 8-cylinder (V8) models decreased by 49.4% while sales of 12-cylinder (V12) models decreased by 42.9%; during the period deliveries of the F Spider and 812 GTS began while the 488 Pista family is reaching the end of its life cycle. All regions suffered a decline in the number of cars delivered, particularly accentuated in Mainland China, Hong Kong and Taiwan (- 91%) not only due to the effect of the pandemic but also due to the decision to bring forward deliveries in 2019. The EMEA area saw a decline of 40.9%, in the Americas the decrease reached 52.6%, finally in the rest of APAC the decrease was equal to 27.9%. Net revenues in the second quarter fell by 42%, going from 984 to 571 million (- 43% at constant exchange rates) and in particular revenues from cars and spare parts decreased by 41% to 450 million (- 42% at constant exchange rates).

Ferrari today publishes 2020 results

Good progress for Ferrari, which today publishes the 2020 results. The stock went up to 181.90 and then stabilized around one euro below the maximum but still growing strongly from the close on Monday at 176.40 euro. For the fourth quarter the consensus of the analysts expects revenues at € 1.058 billion (+ 14.1% y / y), adjusted EBITDA at € 364 million (+ 9.3%, with a margin of approximately 34.4% from 35.9%), adjusted EBIT at 246 million (+ 12.4% y / y, with a margin of around 23.3% from 23.6%), net profit at 186 million (from 166 + 11.8%) and net industrial debt at 538 million from 715 on 30 September.

Ferrari, there is expectation for the name of the new CEO